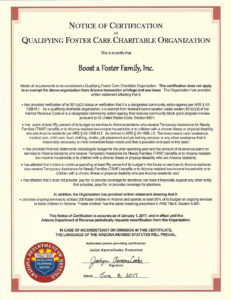

Boost a Foster Family is an Arizona Qualified Foster Care Charitable Organization!

The state of Arizona offers a tax credit for donations made to Qualifying Foster Care Charities. Your donation is a dollar-for-dollar tax credit against your Arizona tax liability.

Taxpayers filing as “single” and “head of household” status may claim a maximum credit of $526. Taxpayers filing as “married filing separate” may claim a maximum credit of $526. Taxpayers that file as “married filing joint” may claim a maximum credit of $1,051.

This is a WIN WIN for you and Boost a Foster Family. You make your donation throughout the tax year (and up to the tax filing deadline) and the funds return to you against your tax liability!

If you take advantage of other AZ State credits (Public School Tax Credit, Private School Tuition credit, and the Qualifying Charitable Organization Credit), you can ALSO take the QUALIFYING FOSTER CARE CHARITABLE ORGANIZATION CREDIT.

Even a person or youth with a part-time job, filing a simple form is able to redirect their taxes. The tax credit is available only to individuals and residents who file taxes in Arizona.

Donors must use our code when filing your Arizona Tax return: QFCO Code: 10043

Questions? See our FAQ's below.

FAQ's about the Arizona Foster Care Tax Credit: